online trading has revolutionized the way people invest and manage their finances. With accessibility at our fingertips, individuals now have the ability to participate in global markets, buy and sell assets, and potentially grow their wealth—all directly from the comfort of their own homes. This blog will break down the basics of online trading, helping you understand how to start and explore this trending investment method.

What Is Online Trading?

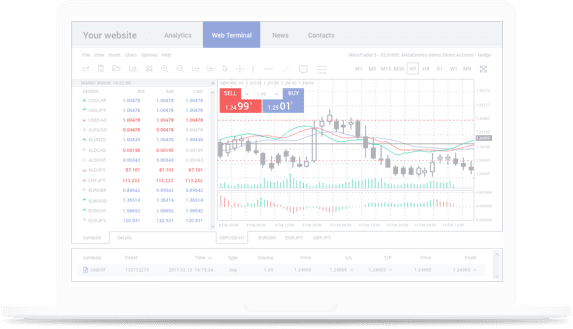

Online trading refers to the buying and selling of financial instruments such as stocks, bonds, forex, commodities, and other assets through web-based platforms. These platforms provide real-time updates, analytics, and tools that make trading more precise and accessible to individuals, whether they are beginners or experienced investors.

The emphasis on technology in trading is evident. Reports indicate that global online trading volumes have witnessed steady growth, with millions of trades executed daily. The rise of user-friendly apps and low-cost brokerage accounts has further contributed to this surge.

Benefits of Online Trading

Understanding the advantages of online trading can motivate individuals to take the plunge into the market. Here are some convincing points:

• Accessibility: Anyone with a computer or smartphone and an internet connection can trade, breaking down geographical barriers.

• Low Transaction Costs: Compared to traditional trading methods, online platforms often offer competitive pricing, making it cost-effective.

• Control and Flexibility: Traders can execute their strategies 24/7, monitor performance, and make instant adjustments as market conditions fluctuate.

• Educational Resources: Online platforms typically offer access to educational materials like webinars, tutorials, and market analyses, empowering new traders.

Key Steps to Get Started with Online Trading

1. Educate Yourself

Understanding basic concepts like market trends, risk management, and types of assets is crucial. Aim to familiarize yourself with terms such as bull and bear markets, diversification, and leverage.

2. Select a Reputable Trading Platform

Research platforms that align with your investment goals and budget. Look for features such as ease of navigation, available asset classes, and analytical tools.

3. Start Small

Begin by investing a small sum to test the waters. Use demo accounts (where available) to practice trading strategies without risking actual money.

4. Diversify Your Portfolio

Avoid putting all your funds into a single asset. Diversification helps minimize risk while maximizing opportunities for returns.

5. Keep Learning and Adjusting

Stay informed about market news, trends, and economic changes. Experiment, analyze your past trades, and fine-tune your strategy over time.

Final Thoughts

Online trading offers an exciting opportunity to participate in financial markets, but success comes with preparation, patience, and continuous learning. By understanding the basics and maintaining a cautious approach, you’ll be better equipped to make informed trading decisions and grow as an investor.